COURSE DESCRIPTION

This course may be eligible for CEUs*

How to Calculate Net and Gross Pay

Good payroll management is key to the running of a business. Fortunately, this is a relatively simple matter now that we have software packages able to calculate tax, National Insurance contributions, and other deductions that need to be taken off an employee’s payslip.

However, it is still essential that you understand the basic concepts underlying these calculations. In this course, you will learn the differences between net and gross pay.

You Will Learn:

- What is meant by the term “gross pay” and how it is calculated

- What is meant by the term “net pay” and how it is calculated

- The most common types of deductions displayed on a payslip

- Why a high-quality payroll package is an essential business tool

- When you should consider manually checking your payroll figures

Benefits of Taking This Course:

- If you are responsible for overseeing a payroll at work, this course will help you fulfil your duties

- This course will prevent you from making mistakes that could cost your business considerable time and money in the long run

- This course will help you work with employees to resolve any difficulties and discrepancies relating to pay

- This course will help you decide who requires payroll training in your business, which is useful if you work in an HR or training role

FREQUENTLY ASKED QUESTIONS

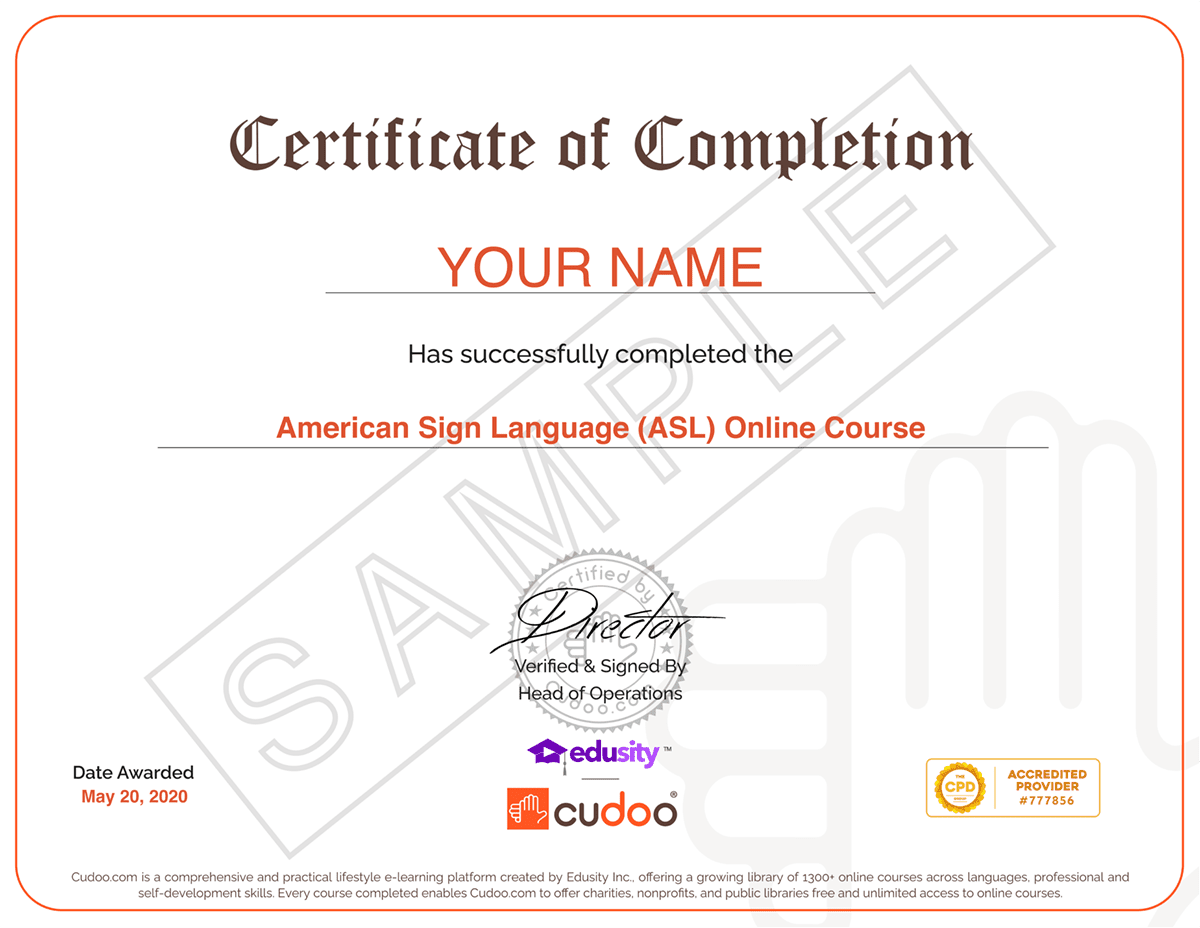

EXAMPLE CERTIFICATE

FIND OUT ABOUT OUR USERS’ EXPERIENCES

1,867 Reviews For Payroll - How To Calculate Net And Gross Pay Certificate

RELATED PRODUCTS

One-time payment

14-Day Money-Back Guarantee

Course features:

- 1 - hour

- Full Lifetime Access

- Certificate of completion

- 8589 Enrolled

Book with Confidence

14-Day Money-Back Guarantee

Looking to train 5 or more people?

Get your team access to Cudoo's library of over 1300 courses.

Try Cudoo EnterpriseDo You have a Question ?

Ask any queries or doubts about this course & get responses from Teachers