To fully comprehend your present financial situation, you should assess your assets and obligations each year. You may use this to set objectives that include short, intermediate, and long-term time spans that are practical and acceptable. Your budget creation or revisions will be guided by these objectives in order to assist your financial success.

We advise using some significant planning possibilities before 2022 ends since 2023 is approaching. Any new year is a difficult period for financial preparation, and the unstable economic environment of today only makes the situation more unclear.

There may not be much time for proactive behavior towards the end of the year because of how busy it might be. Simple suggestions for enhancing your financial planning have been provided.

What Exactly is Financial Planning?

A structured evaluation of one’s financial condition is necessary to plan the strategies and activities necessary to achieve one’s financial objectives. This might include planning for unforeseen costs and working out how to stretch your salary till the next one. However, it may become as complicated as retirement planning, purchasing life insurance, and making stock market and other financial product investments.

Consider financial planning more as a continuous process than as a one-time activity that you complete before moving on. If you’re doing it correctly, you keep a close eye on your financial status and plan ahead often. Accordingly, you will have enough money for everything and you will forget what it is to borrow $50 instantly unless you need emergency money for medical expenses and other unforeseen circumstances.

Simple Financial Planning Tips

Set Financial Objectives

Next, give yourself some time to visualize what you want from life. Everyone will be unique, but some possibilities may include retirement, property ownership, and travel. It could be helpful to give each of your objectives a “why.” By doing this, you may find it simpler to maintain motivation while you try to realize them.

No matter how many objectives you have—three or ten—consider creating buckets or categories for each one. If you have any savings, divide them across the categories according to your comfort level. As you’ll have time to progressively add money to your long-term ambitions, you may wish to start by putting more money toward your immediate or short-term goals. If you’re in your 20s, this guide will help you to save money.

Examine Your Resources and Obligations

You must be completely aware of your financial situation before you can take any action. You should acquire account statements from your bank, retirement, and investment accounts, as well as make a list of your valuables while analyzing your assets and obligations.

Next, you’ll need to collect statements for all of your responsibilities, such as credit card debt and school loans. List every cost that falls within your purview each month. For instance, the amount you anticipate paying for electricity, food, or rent.

Maintain Control Over Debt

In an ideal world, you would have no consumer debt, but that isn’t always feasible. Most professionals in financial planning believe that your total monthly debt payments shouldn’t surpass 30% of your gross monthly income as a benchmark for how much debt is too much.

This is an excellent place to start, and if you can lower that amount over time, you’ll be in decent condition. Your interest rate may be lowered if you consolidate or refinance your student loans, for instance, allowing more of your monthly payment to be applied to the principal. To merge your credit card balances and reduce interest payments, you might also take advantage of a 0% balance transfer offer.

Maintain an Emergency Fund

Making an emergency fund is a crucial element of a good financial strategy.

As you are aware, life is unpredictable, and situations like job loss, family member hospitalization, asset loss, etc., may happen at any moment.

A contingency fund should consist of no more than six months’ worth of saved living expenditures. This covers every price you could have over a typical month, such as utility bills, EMI payments, and other costs. Therefore, a wise strategy would be to set aside some of one’s funds to handle these needs when they come up.

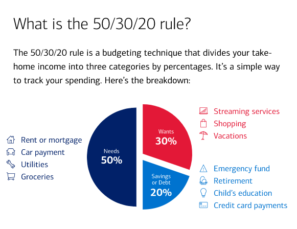

When creating your budget, you can use the 50/30/20 rule, according to which half of your budget should go to your needs, 30% you should spend on vants, and the remaining 20% should be allocated to savings or paying off debt. This rule will allow you to save money and not infringe on yourself.

Make a Personal Finance Calendar

Make a Personal Finance Calendar

Immediately after the New Year is tax season. Make sure you are aware of the paperwork required to submit your taxes and ask a tax expert whether you qualify for any tax incentives.

A preventative approach is keeping a detailed personal financial schedule. Its most important role is keeping you from spending more than you have to, in addition to allowing you to keep track of the days when you may be able to save money.

For instance, although most individuals dislike paying their taxes, doing so on time prevents you from incurring late payments or filing fees. A calendar is one of the effective budgeting tools that enables you to schedule significant expenses like Christmas shopping.

Review Your Insurance Coverage

Your financial plan should include life and health insurance, particularly if your family relies on your salary to pay bills on a regular basis. You can find cheap life and health insurance alternatives that provide coverage for the whole family.

If you already have life and health insurance, you may think about reviewing it to make sure it meets all of your financial and medical needs.

Regularly Review Your Financial Strategy

The likelihood of achieving objectives rises with frequent financial plan reviews. This makes it easier for you to adapt to any personal or financial changes. It helps in monitoring if these investments will assist you in accomplishing your intended aims.

For instance, it would be wise to periodically review your existing position if you invested in stocks. It’s conceivable that a stock or equity mutual fund isn’t performing as expected. Therefore, periodically check your strategy and remove items that are no longer valuable to your portfolio.

Conclusion

Making a financial strategy today might position you for success in the future. As your income increases, you’ll be able to allocate more money precisely. You’ll be well on your way to having a financial life that supports your hopes and objectives with just a little bit of beginning planning, budgeting, and discipline.

Joseph

Latest posts by Joseph (see all)

- Financial Planning in 2023: A Simple Guide - December 7, 2022

- Finding the Most Suitable Mobile Phone Plans for You - November 16, 2022

- The Various SEO Service Types for Law Firms - November 9, 2022

Make a Personal Finance Calendar

Make a Personal Finance Calendar